Why does the Action Score fluctuate?

Why does the Action Scores fluctuate wildly? and is this volatility an error in the system?

Let me zoom out to give you the fuller picture to help you better understand the various reasons why this occurs and what affects the Action Score.

To quickly review, here are the data points that make up the Action Score. I discussed how the Action is created in an earlier email.

- FCF/Sales

- CROIC

- Piotroski score

- P/FCF

- EV/EBIT

- P/B

- TTM sales percentage change

- 5 year sales CAGR

- Gross Profit to Asset Ratio (GPA)

#1. Piotroski Score Causes Stocks to Rise and Fall

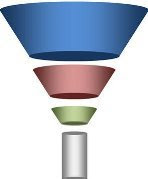

The Piotroski Score is the first blue layer for the Q, V and G score.In order to keep the list and ranking as clean and high quality as possible, the Piotroski score plays a big role in what goes down the funnel or stays out.

E.g. PRKA had a Piotroski Score of 5 in 2014, but then jumped to an 8 in 2015.

Same rule applies to quarterly periods.

If a stock had a high Piotroski score of 8 but then fell to a 5 in the latest reported quarter, the Action Score will drop as a result because the Piotroski Score is importantfor Q,V and G.

The quickest way a stock will rise or drop in rank is if the Piotroski Score changes in a big way.

But why?

During my tests and studies, I wanted to leverage a proven system. I'm not interested in reinventing the wheel. The Piotroski Score has been studied and tested extensively which is why I wanted to use it.

By not having the Piotroski Score as the first line of defense, too many stocks rocketed to the top 10 because of a single crazy number.

A stock like GRSU with a CROIC 4,366.9% would squat high on the list.

By awarding stocks with Piotroski Scores in the optimal range of 7-9 and penalizing stocks with low Piotroski Scores (1-4), I'm able to pass stocks down the funnel that meet accounting and quality standards before the rest of the calculations for Q,V and G are processed.

#2. Metrics with the Highest Weightings

- For Quality: CROIC has the highest weighting.

- For Value: P/FCF has the highest weighting with EV/EBIT also getting a high weighting.

- For Growth: Gross Profit to Total Asset has the highest weighting

And you also see that Value includes 2 metrics with high weightings that rely on price. If the market is volatile, the value score is the first one to adjust, which again causes jumps as we update our scores daily. Not weekly or monthly like many other sites that rank stocks.

#3. Not Filtered

The last point to understand is that when you download the spreadsheet with the entire database of stocks and scores, it is not filtered.

If I hide stocks that don't meet certain industry or metrics, you'll have a cleaner and shorter list for sure with less volatility.

But to give you more control, I'm dumping the entire database of stocks for now.

The Action Score is also not suited for financial stocks like banks, insurance, REIT's. That's something I want to improve down the road. Therefore, these financial stocks also tend to stir the waters depending on market conditions.

Hope that gives you a better background and understanding of the backstory and theory behind how the Action Score is graded and ranked.

Customer support service by UserEcho